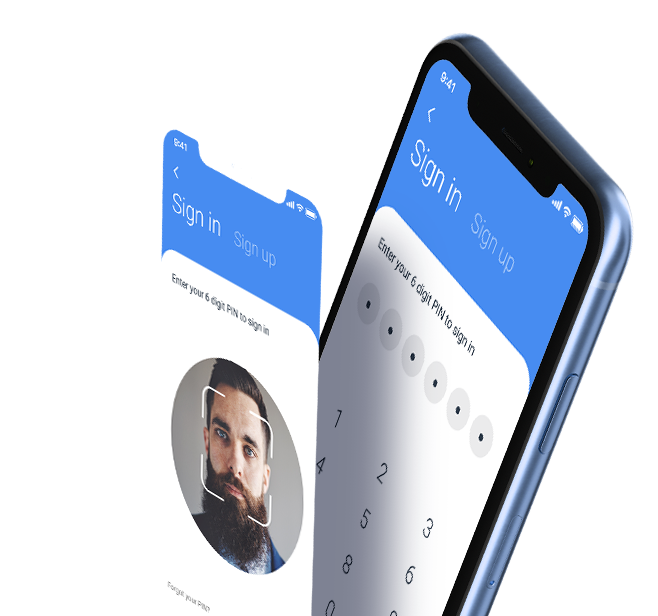

Mobile-first banking

- Mobile onboarding and account opening

- P2P mobile payments and money transfers

- Real-time notifications and spending alerts

- Financial literacy mobile apps

- AR-enabled navigation to ATMs and branches

Since 2005, Global Software & Consultants has been helping fintech providers, financial data vendors, institutions, and banks to envision, fulfill, and protect their clients’ financial dreams.

Our decade-long experience allows us to deeply understand inherent industry intricacies and unique business challenges to deliver enterprise-grade banking and financial software solutions that support digital transformation and drive measurable results.

Transform your core environment to perform tasks easier, deliver services faster, achieve and beat targets more efficiently, lower operating costs, and more.

Manage risk, ensure compliance and combat crime across assets and portfolios with comprehensive data management capabilities throughout the entire enterprise.

Manage vast volumes of data and make them work for you in every aspect of your business, including marketing, decision-making, revenue optimization, and much more.

Leverage our comprehensive API development expertise to easily connect with your trusted partners, access new services, and enhance banking experiences for your customers.

Deliver outstanding, personalized customer experiences across all your channels through data-driven insights into every customer’s needs.

Let us help you enhance your financial services and achieve a competitive edge. Contact us now for a no-strings estimate.

We help banking institutions thrive on a fast-changing financial landscape by catering to the needs of their mobile-first customers, delivering innovative experiences, and mining intelligent insights with ease.